Taxes are an essential part of financial planning, and understanding the 2024 tax brackets is crucial for optimizing your finances. Whether you're a working professional, a business owner, or simply someone looking to better manage your money, knowing how tax brackets work can make a significant difference. This article will break down everything you need to know about the 2024 tax brackets, including how they affect your income, deductions, and overall tax liability.

Taxes may seem complex, but they don't have to be overwhelming. By the end of this guide, you'll have a clear understanding of how the 2024 tax brackets work and how they impact your financial situation. We'll also provide practical tips to help you minimize your tax burden legally and effectively.

This article is designed to be a comprehensive resource for anyone looking to stay informed about tax regulations. From explaining the basics of tax brackets to offering strategies for tax planning, we've got you covered. Let's dive in and explore the world of 2024 tax brackets.

Read also:Unveiling The Thrills Of Champions League A Comprehensive Guide To The Worlds Prestigious Football Tournament

Table of Contents

- What Are Tax Brackets?

- 2024 Tax Brackets Overview

- How Tax Brackets Affect You

- Filing Status Options

- Capital Gains Tax Brackets

- Deductions and Credits

- Tax Planning Strategies for 2024

- Common Mistakes to Avoid

- Future Tax Bracket Changes

- Conclusion and Next Steps

What Are Tax Brackets?

Tax brackets refer to the ranges of income that are taxed at specific rates. In the United States, the federal income tax system operates on a progressive scale, meaning that higher levels of income are taxed at higher rates. For example, if you earn $50,000, only the portion of your income above a certain threshold will be taxed at the higher rate.

Understanding tax brackets is essential because it helps individuals plan their finances and minimize their tax liability. The IRS updates these brackets annually to account for inflation, ensuring that taxpayers aren't unfairly burdened by rising costs.

How Tax Brackets Work

Here’s a simplified explanation of how tax brackets function:

- Your income is divided into segments, and each segment is taxed at a different rate.

- Only the portion of your income that falls within a higher bracket is taxed at the higher rate.

- This system ensures that lower-income individuals pay less in taxes compared to those with higher incomes.

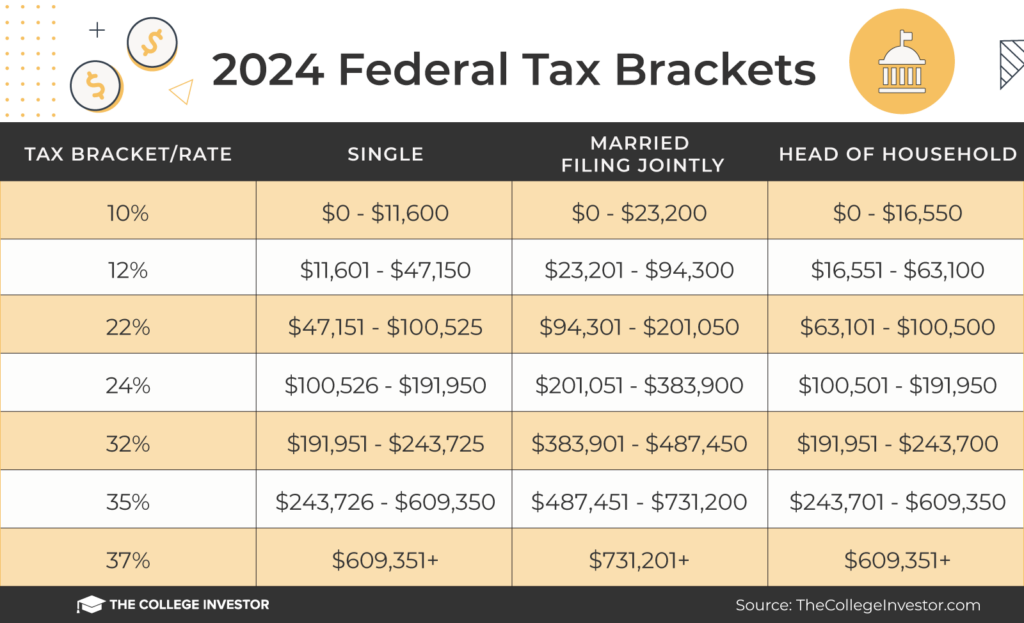

2024 Tax Brackets Overview

The 2024 tax brackets are set to reflect inflation adjustments, ensuring fairness in the tax system. Below is a breakdown of the tax brackets for various filing statuses:

Single Filers

For single filers in 2024, the tax brackets are as follows:

- 10% on income up to $11,000

- 12% on income over $11,000 to $44,725

- 22% on income over $44,725 to $95,375

- 24% on income over $95,375 to $182,100

- 32% on income over $182,100 to $231,250

- 35% on income over $231,250 to $578,125

- 37% on income over $578,125

Married Filing Jointly

For married couples filing jointly, the brackets are adjusted accordingly:

Read also:Tyler Herro The Rising Star In The Nba

- 10% on income up to $22,000

- 12% on income over $22,000 to $89,450

- 22% on income over $89,450 to $190,750

- 24% on income over $190,750 to $364,200

- 32% on income over $364,200 to $462,500

- 35% on income over $462,500 to $693,750

- 37% on income over $693,750

How Tax Brackets Affect You

Knowing your tax bracket is important because it directly influences how much you owe in taxes. For instance, if you're in the 22% tax bracket, only the portion of your income above the previous bracket will be taxed at 22%. This means you won't pay 22% on your entire income, but rather just the portion that falls within that bracket.

Effective Tax Rate

Your effective tax rate is the average rate you pay on your total taxable income. It's usually lower than your marginal tax rate (the highest bracket you fall into). This is because of the progressive nature of the tax system.

Filing Status Options

Your filing status determines which tax brackets apply to you. The IRS recognizes several filing statuses:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Qualifying Widow(er)

Choosing the right filing status can significantly impact your tax liability, so it's important to select the one that best fits your situation.

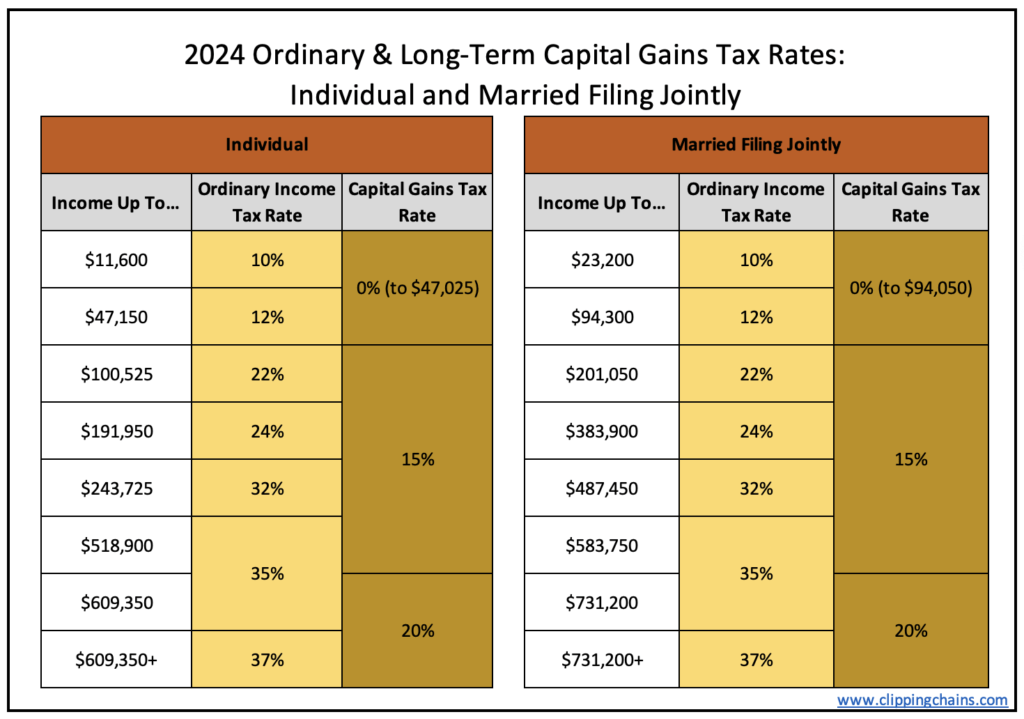

Capital Gains Tax Brackets

Capital gains taxes apply to profits from the sale of assets like stocks, real estate, or investments. These taxes are also subject to brackets, which vary depending on your income and filing status.

2024 Capital Gains Rates

For 2024, the capital gains tax rates are:

- 0% for taxpayers in the 10% and 12% brackets

- 15% for taxpayers in the 22% to 35% brackets

- 20% for taxpayers in the 37% bracket

Deductions and Credits

Tax deductions and credits can significantly reduce your tax liability. Deductions lower your taxable income, while credits directly reduce the amount of tax you owe.

Standard Deduction

In 2024, the standard deduction amounts are:

- $13,850 for single filers

- $27,700 for married filing jointly

- $20,800 for head of household

Tax Credits

Some common tax credits include:

- Child Tax Credit

- Earned Income Tax Credit (EITC)

- American Opportunity Credit

Tax Planning Strategies for 2024

Effective tax planning can help you maximize your savings and reduce your tax burden. Here are some strategies to consider:

- Contribute to retirement accounts like IRAs or 401(k)s to lower your taxable income.

- Take advantage of tax-advantaged investment accounts, such as Roth IRAs.

- Harvest tax losses by selling underperforming investments to offset gains.

Common Mistakes to Avoid

Mistakes in tax planning can lead to unnecessary expenses. Here are some common errors to watch out for:

- Underestimating your tax bracket and failing to plan accordingly.

- Not taking advantage of available deductions and credits.

- Missing deadlines for tax-related actions, such as IRA contributions.

Future Tax Bracket Changes

Tax brackets are subject to change due to legislative actions or inflation adjustments. It's important to stay informed about potential changes that could affect your financial planning.

Conclusion and Next Steps

Understanding the 2024 tax brackets is a critical step in managing your finances effectively. By knowing how these brackets work and utilizing available deductions and credits, you can minimize your tax liability and maximize your savings.

We encourage you to take action by reviewing your financial situation and consulting with a tax professional if needed. Don't forget to share this article with others who may find it helpful and explore more resources on our website for further guidance.