Understanding the PCE report is essential for anyone interested in economics, finance, or investing. This report serves as a critical indicator of consumer spending and inflation, influencing monetary policy decisions and market trends. It provides valuable insights into the health of the economy and how consumers are behaving in real-time.

The PCE report, short for Personal Consumption Expenditures, is one of the most important economic indicators for policymakers and investors alike. It measures the goods and services purchased by consumers, reflecting their spending habits and preferences. As a result, it plays a pivotal role in shaping economic policies and forecasting future market movements.

In this article, we will delve into the intricacies of the PCE report, exploring its significance, how it's calculated, and its impact on the economy. By the end, you'll have a thorough understanding of why the PCE report matters and how it affects your financial decisions.

Read also:Comprehensive Guide To Insurance Everything You Need To Know

Table of Contents

- Introduction to PCE Report

- How the PCE Report is Calculated

- Why the PCE Report is Important

- PCE Report and Inflation

- Impact on Monetary Policy

- How the PCE Report Affects the Market

- Key Data Points in the PCE Report

- Limitations of the PCE Report

- PCE vs CPI

- Future Trends in PCE Reporting

- Conclusion

Introduction to PCE Report

The Personal Consumption Expenditures (PCE) report is a vital economic indicator that measures consumer spending in the United States. It is published monthly by the Bureau of Economic Analysis (BEA) and provides detailed information on how much consumers are spending on goods and services. The report is crucial because consumer spending accounts for approximately 70% of the U.S. economy.

Understanding the PCE report is important for businesses, investors, and policymakers. It offers insights into consumer behavior, economic health, and inflation trends. By analyzing the PCE report, stakeholders can make informed decisions about investments, pricing strategies, and fiscal policies.

What is the PCE Report?

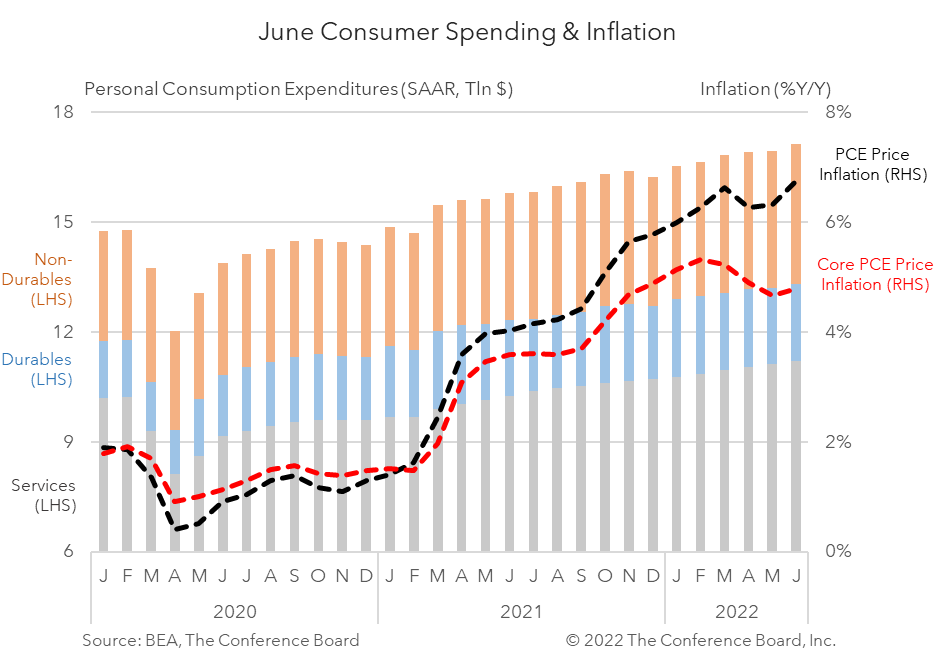

The PCE report tracks the money spent by households on various goods and services, including durable goods, non-durable goods, and services. It also measures the price changes of these items, providing a comprehensive view of inflationary pressures. This makes the PCE report a preferred measure of inflation by the Federal Reserve.

How the PCE Report is Calculated

The PCE report is calculated using a complex methodology that involves gathering data from multiple sources. The BEA collects information from businesses, surveys, and administrative records to estimate consumer spending. This data is then adjusted for seasonal variations and inflation to produce a reliable and accurate report.

Data Sources

- Retail sales data

- Consumer surveys

- Government records

- Industry reports

Why the PCE Report is Important

The PCE report is a key economic indicator that influences monetary policy decisions and market trends. It provides valuable insights into consumer spending patterns and inflation, which are critical for economic forecasting. By analyzing the PCE report, policymakers can make informed decisions about interest rates, fiscal policies, and economic growth strategies.

Read also:Rod Stewart A Legendary Voice And Timeless Icon

Key Benefits of the PCE Report

- Measures consumer spending accurately

- Provides insights into inflation trends

- Influences monetary policy decisions

- Helps businesses plan for the future

PCE Report and Inflation

Inflation is a critical factor in the PCE report, as it measures the price changes of goods and services over time. The PCE price index, a component of the PCE report, is widely regarded as a more accurate measure of inflation than the Consumer Price Index (CPI). This is because the PCE index accounts for changes in consumer behavior and substitution effects.

How Inflation is Measured

Inflation is measured by comparing the current prices of goods and services to their prices in a base year. The PCE price index uses a formula that adjusts for changes in consumer preferences and spending patterns, providing a more comprehensive view of inflationary pressures.

Impact on Monetary Policy

The PCE report has a significant impact on monetary policy, as it is one of the primary indicators used by the Federal Reserve to assess inflation. The Fed uses the PCE report to determine whether inflation is within its target range and whether interest rate adjustments are necessary. This makes the PCE report a critical tool for maintaining economic stability.

Monetary Policy Tools

- Interest rate adjustments

- Open market operations

- Quantitative easing

How the PCE Report Affects the Market

The PCE report can have a substantial impact on financial markets, as it influences investor sentiment and market expectations. When the PCE report shows strong consumer spending and low inflation, it can boost investor confidence and drive stock prices higher. Conversely, weak consumer spending and high inflation can lead to market volatility and uncertainty.

Market Reactions

- Increased stock prices with strong PCE data

- Higher bond yields with rising inflation

- Volatility in currency markets

Key Data Points in the PCE Report

The PCE report includes several key data points that provide insights into consumer spending and inflation. These data points include total personal consumption expenditures, real PCE, and the PCE price index. By analyzing these metrics, stakeholders can gain a deeper understanding of economic conditions and market trends.

Important Metrics

- Total PCE: Measures overall consumer spending

- Real PCE: Adjusted for inflation

- PCE Price Index: Tracks inflation trends

Limitations of the PCE Report

While the PCE report is a valuable economic indicator, it does have some limitations. For example, the report is based on estimates and can be subject to revision. Additionally, it may not capture all aspects of consumer behavior, particularly in rapidly changing markets. Understanding these limitations is important for interpreting the PCE report accurately.

Common Limitations

- Data revisions

- Limited scope of consumer behavior

- Delayed reporting

PCE vs CPI

The PCE report and the Consumer Price Index (CPI) are both measures of inflation, but they differ in methodology and scope. The PCE report is considered a more comprehensive measure of inflation because it accounts for changes in consumer behavior and substitution effects. The CPI, on the other hand, focuses on a fixed basket of goods and services, which may not reflect real-world spending patterns.

Comparison Table

| Indicator | PCE | CPI |

|---|---|---|

| Methodology | Accounts for substitution effects | Fixed basket of goods |

| Scope | Comprehensive | Narrower |

Future Trends in PCE Reporting

As technology advances and consumer behavior evolves, the PCE report is likely to incorporate new data sources and methodologies. This will enhance its accuracy and relevance in measuring consumer spending and inflation. Policymakers and investors should stay informed about these developments to make better decisions in the future.

Emerging Trends

- Increased use of big data

- Improved data collection methods

- Enhanced analytical tools

Conclusion

The PCE report is a critical economic indicator that provides valuable insights into consumer spending and inflation. By understanding the PCE report, stakeholders can make informed decisions about investments, pricing strategies, and fiscal policies. As the economy continues to evolve, the PCE report will remain an essential tool for assessing economic health and forecasting future trends.

We encourage you to share your thoughts and questions about the PCE report in the comments section below. Additionally, feel free to explore other articles on our site for more insights into economics and finance. Together, let's stay informed and make better financial decisions!