Tesla earnings have become one of the most anticipated events in the financial world. The electric vehicle (EV) giant continues to set new benchmarks, reshaping the automotive industry with its innovative approach and technological advancements. Investors and analysts alike eagerly await Tesla's quarterly reports to gauge its growth trajectory and future prospects.

Tesla's success story is not just about selling cars; it's about revolutionizing the way we think about transportation, energy consumption, and sustainability. The company's earnings reports provide valuable insights into its financial health, market positioning, and strategic initiatives. Understanding these reports is crucial for anyone interested in the EV sector or looking to invest in Tesla.

As the global shift towards renewable energy accelerates, Tesla remains at the forefront of this transformation. Its earnings announcements offer a glimpse into the company's ability to capitalize on emerging trends and maintain its leadership position in the EV market. In this article, we will explore Tesla's earnings in detail, analyzing key metrics, growth drivers, and future opportunities.

Read also:Exploring The Rich Tapestry Of Russian Culture History And Influence

Table of Contents

- Tesla Earnings Overview

- Revenue Growth and Key Drivers

- Profitability Analysis

- Cash Flow Management

- Market Position and Competitor Analysis

- Innovation and R&D Investments

- Sustainability Initiatives

- Regulatory Environment and Challenges

- Future Growth Opportunities

- Conclusion and Call to Action

Tesla Earnings Overview

Tesla's earnings reports have consistently generated excitement and speculation in the financial markets. The company's ability to deliver strong financial results while investing heavily in innovation and expansion has solidified its reputation as a leader in the EV industry. Each quarter, Tesla provides updates on its revenue, profitability, production, and delivery figures, offering investors a comprehensive view of its operational performance.

Key Financial Metrics

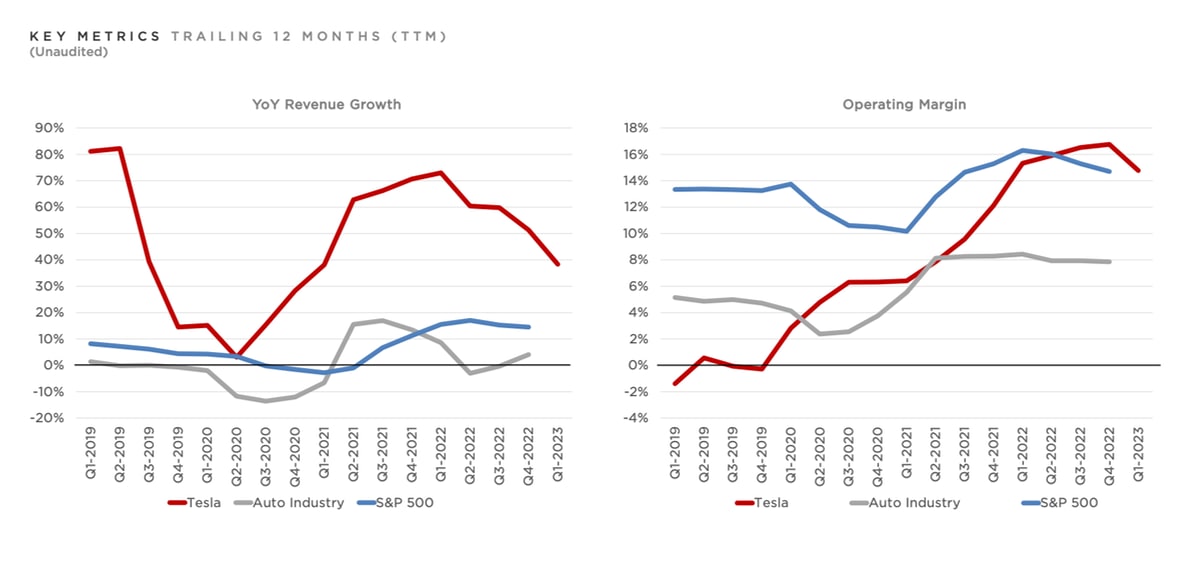

Tesla's earnings reports focus on several critical metrics, including revenue growth, gross margins, operating expenses, and net income. These figures help assess the company's financial health and sustainability. Additionally, Tesla highlights its production and delivery numbers, which are key indicators of demand and market acceptance.

Recent quarters have shown impressive growth across all these metrics, driven by increasing global demand for EVs, expanding production capacity, and successful new product launches. Tesla's ability to achieve profitability while investing in long-term growth initiatives has been a testament to its strategic acumen.

Revenue Growth and Key Drivers

Tesla's revenue growth has been nothing short of remarkable. Over the past few years, the company has consistently reported double-digit revenue increases, fueled by rising EV sales, expanding product offerings, and growing energy storage and solar businesses.

Factors Driving Revenue Growth

- Increased production and delivery volumes

- Expansion into new markets, including Europe and Asia

- Strong demand for Model 3 and Model Y

- Growth in energy storage and solar products

- Revenue from regulatory credits

Data from Tesla's recent earnings reports indicate that the company's revenue streams are diversifying, reducing reliance on any single product line. This diversification enhances Tesla's resilience and long-term growth potential.

Profitability Analysis

Profitability has been a key focus for Tesla, as the company strives to balance growth with financial sustainability. Over the years, Tesla has demonstrated its ability to achieve profitability while investing in future growth initiatives. This has been made possible through operational efficiencies, economies of scale, and strategic cost management.

Read also:Europa League Draw A Comprehensive Guide To The Exciting Tournament

Key Profitability Metrics

- Gross margins: Tesla's gross margins have consistently improved, reflecting operational efficiencies and economies of scale.

- Operating expenses: The company has managed to control operating expenses while increasing R&D investments.

- Net income: Tesla has reported positive net income for several consecutive quarters, a significant milestone for any EV manufacturer.

According to data from Tesla's financial statements, the company's profitability is expected to improve further as production scales and costs decrease. This trend bodes well for Tesla's long-term financial health.

Cash Flow Management

Cash flow management is a critical aspect of Tesla's financial strategy. The company's ability to generate positive cash flow from operations has been instrumental in funding its growth initiatives and reducing reliance on external financing. Tesla's cash flow statements provide insights into its liquidity position and financial flexibility.

Key Cash Flow Metrics

- Cash flow from operations: Tesla has consistently reported positive cash flow from operations, reflecting its strong operational performance.

- Capital expenditures: The company continues to invest heavily in production capacity, R&D, and infrastructure development.

- Free cash flow: Tesla's free cash flow has improved significantly, enabling the company to fund its growth initiatives without diluting shareholder value.

By maintaining a strong cash flow position, Tesla ensures its ability to execute its strategic plans and capitalize on emerging opportunities in the EV market.

Market Position and Competitor Analysis

Tesla's market position in the EV industry is unparalleled. The company's leadership in technology, brand recognition, and production capacity gives it a significant competitive advantage. However, the EV market is becoming increasingly crowded, with traditional automakers and new entrants vying for market share.

Competitive Landscape

- Traditional automakers: Companies like General Motors, Ford, and Volkswagen are investing heavily in EVs, posing a challenge to Tesla's dominance.

- New entrants: Startups and tech companies are entering the EV market, bringing innovative solutions and competitive pricing.

- Regulatory pressures: Governments worldwide are implementing stricter emissions regulations, creating both opportunities and challenges for Tesla.

Despite the increasing competition, Tesla's first-mover advantage, technological leadership, and strong brand equity continue to set it apart from its rivals.

Innovation and R&D Investments

Innovation lies at the heart of Tesla's success. The company invests heavily in research and development (R&D), focusing on advancing battery technology, autonomous driving capabilities, and manufacturing processes. These investments ensure Tesla remains at the forefront of technological advancements in the EV industry.

Key Innovation Areas

- Battery technology: Tesla's advancements in battery technology have significantly improved the range and efficiency of its EVs.

- Autonomous driving: The company's Autopilot and Full Self-Driving (FSD) capabilities are leading the charge in autonomous vehicle development.

- Manufacturing innovations: Tesla's Gigafactories and production innovations have reduced costs and increased efficiency.

According to industry reports, Tesla's R&D investments are paying off, as the company continues to push the boundaries of what is possible in the EV space.

Sustainability Initiatives

Sustainability is a core pillar of Tesla's mission. The company is committed to accelerating the world's transition to sustainable energy through its EVs, energy storage solutions, and solar products. Tesla's sustainability initiatives align with global efforts to combat climate change and reduce carbon emissions.

Sustainability Highlights

- Carbon neutrality: Tesla aims to achieve carbon neutrality across its operations and supply chain.

- Renewable energy: The company's energy storage and solar products promote the adoption of renewable energy sources.

- Recycling programs: Tesla has implemented battery recycling programs to minimize waste and promote circular economy principles.

Tesla's commitment to sustainability not only benefits the environment but also enhances its brand reputation and customer loyalty.

Regulatory Environment and Challenges

The regulatory environment plays a crucial role in shaping the EV industry. Governments worldwide are implementing policies and incentives to promote the adoption of EVs and reduce carbon emissions. While these regulations present opportunities for Tesla, they also pose challenges that the company must navigate.

Key Regulatory Challenges

- Trade policies: Tariffs and trade restrictions can impact Tesla's global operations and supply chain.

- Safety regulations: Evolving safety standards for autonomous vehicles require ongoing investments in technology and compliance.

- Environmental regulations: Stricter emissions standards and recycling requirements necessitate continuous innovation and adaptation.

Tesla's ability to adapt to changing regulatory environments is a testament to its strategic agility and commitment to sustainability.

Future Growth Opportunities

Tesla's future growth opportunities are vast, driven by expanding global demand for EVs, emerging markets, and new product lines. The company's strategic initiatives and investments position it well to capitalize on these opportunities and maintain its leadership position in the EV industry.

Key Growth Drivers

- Global expansion: Tesla's expansion into new markets, including India and Southeast Asia, presents significant growth potential.

- New product lines: The launch of the Cybertruck, Semi, and Roadster offers new revenue streams and market opportunities.

- Energy solutions: Tesla's energy storage and solar products are poised for growth as the world shifts towards renewable energy.

Analysts predict that Tesla's revenue and profitability will continue to grow, driven by these and other strategic initiatives. The company's focus on innovation, sustainability, and operational excellence ensures its long-term success.

Conclusion and Call to Action

Tesla's earnings reports provide valuable insights into the company's financial performance, growth drivers, and future prospects. From revenue growth and profitability to innovation and sustainability, Tesla continues to set new benchmarks in the EV industry. As the global shift towards renewable energy accelerates, Tesla remains at the forefront of this transformation, reshaping the way we think about transportation and energy consumption.

We invite you to engage with this content by leaving your thoughts in the comments section below. Share this article with your network to spread awareness about Tesla's achievements and future potential. For more in-depth analysis and updates on the EV industry, explore our other articles and resources. Together, let's stay informed and contribute to a sustainable future.